Trajectory Daily Brief: 11 January 2026

Sudan's 150,000 dead get 6% of Gaza's funding. Trump's $1.5T defense budget hits production walls. Philippines' $30B digital economy threads through Chinese waters as UAE preps for Iran.

Africa | Conflict | Sudan’s humanitarian crisis exceeds Gaza scale but receives 6% funding versus Gaza’s 104%

Situation

Sudan’s civil war between the Sudanese Armed Forces and Rapid Support Forces has killed over 150,000 people and displaced 12 million since April 2023. The International Rescue Committee ranks it the largest humanitarian crisis ever recorded, accounting for 10% of global humanitarian need despite Sudan representing just 1% of world population.

The UN’s 2024 Sudan appeal received less than 6% funding before emergency pledges, while Gaza’s Flash Appeal achieved 104% funding. Major powers have deployed no strategic assets or convened emergency summits for Sudan.

Context

Sudan’s invisibility stems from structural illegibility to Western attention systems rather than simple crisis fatigue. The conflict lacks clear aggressor-victim narratives that media requires, presenting instead a power struggle between two generals with blurred ideological distinctions and shifting territorial control.

The UAE exemplifies strategic opportunism, simultaneously providing $100 million in humanitarian aid while allegedly supplying RSF weapons. Dubai’s hawala networks enable Wagner Group gold extraction without regulated banking conversion, creating systematic advantages over Western state actors.

Destroyed telecommunications infrastructure prevents both internal resistance coordination and external verification workflows, while algorithmic content moderation suppresses graphic humanitarian imagery that might generate public pressure.

Trajectory

Sudan demonstrates how narrative illegibility creates strategic blindness in major powers. Conflicts requiring complex intervention templates receive minimal attention compared to those offering clear “savior narrative opportunities.”

Regional powers are filling the vacuum through proxy relationships and resource extraction partnerships that will outlast any eventual peace settlement. The systematic destruction of Sudan’s institutional architecture creates long-term dependency on external actors willing to operate through informal channels.

This pattern will likely repeat in future complex emergencies that lack binary conflict structures or strategic assets triggering great-power competition.

US | Defence | Trump’s $1.5 trillion defence budget proposal faces industrial base bottlenecks despite readiness crisis

Situation

President Trump proposed a $1.5 trillion defence budget for 2026—a 50% increase over current levels—citing military readiness concerns. The Government Accountability Office confirms U.S. military readiness “has been degraded over the last two decades,” with Navy fleet readiness at 68% and persistent maintenance backlogs across services.

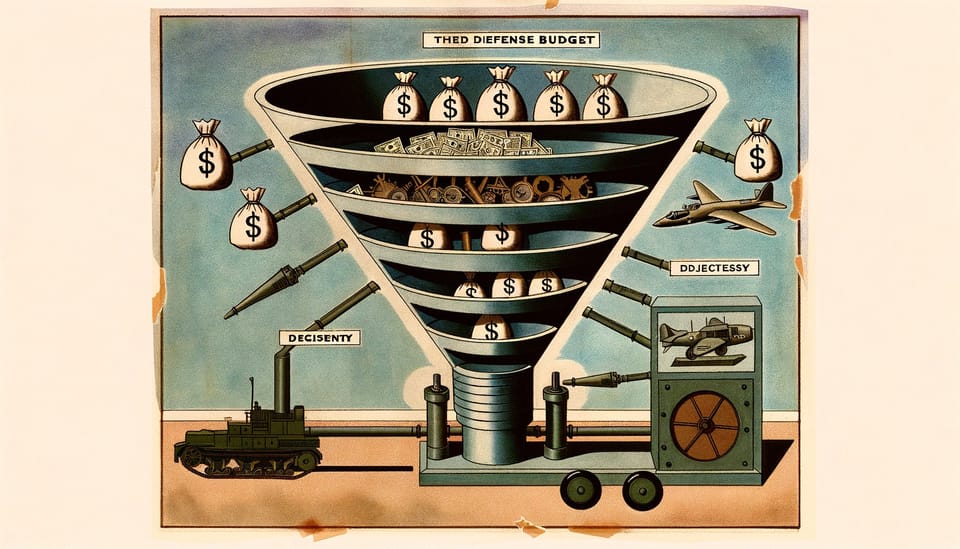

However, from 2020-2024, the top five defence contractors received $771 billion in Pentagon contracts while converting improved profit margins into 73% higher shareholder payments rather than expanding production capacity. Ukraine’s conflict exposed production constraints when artillery shell manufacturing couldn’t scale to meet demand.

Context

The defence industrial base consolidated from 51 prime contractors in the 1990s to five today, reducing competition and creating monopoly pricing dynamics. These contractors decreased capital expenditure and R&D investment even as profits rose between 2000-2019, prioritising dividends over capacity building.

Pentagon acquisition rules create structural biases toward new platform purchases over maintenance of existing equipment. The “full funding policy” requires upfront budgeting for procurement while operations and maintenance compete for remaining funds. The F-35 program exemplifies this dysfunction—$6 billion over budget with 238-day average delivery delays in 2024.

Small contractors increasingly refuse to bid due to regulatory compliance burdens that only large firms can navigate, further entrenching oligopoly control.

Trajectory

A 50% budget increase would flow through the same concentrated industrial structure without addressing underlying capacity constraints. The five major primes would absorb most new contracts, benefiting shareholders while production bottlenecks persist.

Military readiness operates on timescales—training cyber operators takes 50 weeks, building shipyards takes decades—that annual budget cycles cannot accommodate. Without acquisition reform and industrial base diversification, increased spending will generate contractor profits rather than deployable capability.

China | Technology | Philippines’ submarine cable infrastructure creates undefendable chokepoints for $30 billion digital economy

Situation

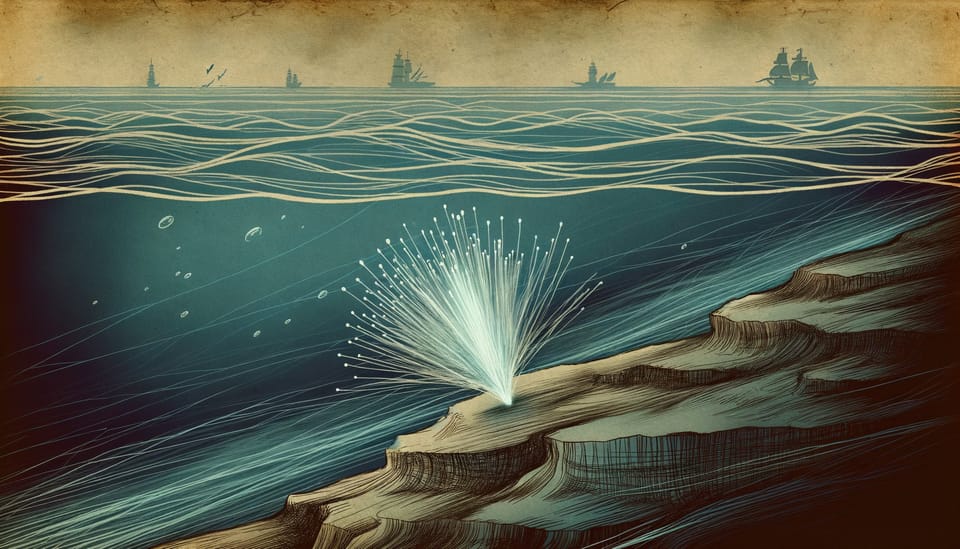

The Philippines depends on approximately 16,000 kilometers of submarine cables threading through Chinese-claimed waters to support its $30 billion business process outsourcing industry employing 1.5 million people. These cables, carrying 95% of digital traffic, must traverse the Luzon Strait where Chinese research vessels conduct 20-22 annual surveys.

The February 2023 Matsu Islands incident established the vulnerability template: a Chinese-registered vessel severed two cables with anchor drags, cutting internet access for 14,000 residents for weeks. Beijing dismissed it as a “common maritime incident” despite the vessel’s AIS transponder being disabled during the critical period.

Cable landing points create geographic chokepoints where attacks on three or four stations could sever the country’s digital nervous system entirely.

Context

The Philippines has externalized its cognitive economy to submarine infrastructure that international law cannot adequately protect. UNCLOS Article 79 grants cable-laying freedom but provides legal ambiguity around defensive measures against potential sabotage disguised as accidents.

Gray zone operations exploit this gap perfectly. Each incident remains individually deniable while achieving cumulative strategic effects. Natural turbidity currents in the Luzon Strait create a “noise floor” making attribution structurally difficult without continuous underwater surveillance capabilities the Philippines lacks.

The US Mutual Defense Treaty’s Article 5 threshold was designed for conventional attacks, not coordinated cable cuts. Private sector actors like Meta and Google now own more cable infrastructure than the US Navy can repair, creating a civil-military dependency inversion.

Trajectory

Alliance commitments exist in quantum superposition until attribution attempts force revelation of actual defensive commitments. The legal architecture provides no automatic escalation pathway for submarine infrastructure attacks below the armed attack threshold.

The Philippines faces an unsolvable defensive equation: economic survival requires infrastructure that cannot be meaningfully protected under current legal and military frameworks. This creates a permanent vulnerability that sophisticated adversaries can exploit through plausibly deniable means.

The model established at Matsu will likely proliferate across Southeast Asia’s cable-dependent economies, testing alliance credibility through infrastructure rather than territory.

Middle East | Analysis | UAE withdraws from Red Sea positions to concentrate forces for potential Gulf-Iran confrontation

Situation

The UAE has systematically withdrawn military forces from Yemen since 2019, dismantling its major Eritrean base at Assab in 2021 while shifting to smaller installations across Yemeni islands including Socotra and Zuqar. This follows 2022 Houthi missile strikes on Abu Dhabi that demonstrated Iranian proxy capabilities to reach Emirati territory.

The withdrawal reflects force allocation constraints for a nation of 1.2 million citizens attempting to defend both the Bab el-Mandeb and Strait of Hormuz chokepoints simultaneously. UAE military operations had relied heavily on Pakistani trainers, Colombian mercenaries, and Sudanese infantry rather than indigenous forces.

Context

Iran’s uranium enrichment has reached 60% purity with particles detected at 84%—approaching weapons-grade levels—compressing potential nuclear capability timelines from years to months. This has forced UAE strategic planners to prioritize homeland defense over expeditionary operations in a zero-sum competition for finite military assets.

The UAE’s 2020 Abraham Accords with Israel and 2024 Major Defense Partner status with the US create alliance burden-sharing that makes Red Sea withdrawal strategically viable. Israeli sensor integration and US Gulf security guarantees reduce pressure on Emirati forces to maintain independent coverage of multiple theaters.

The shift from large bases to “flexible outposts” trades sustained combat capability for distributed surveillance networks that present harder targets for Iranian proxy forces.

Trajectory

UAE force concentration signals expectation of Gulf conflict within operationally relevant timeframes, not strategic overextension. The Emirates is conducting military triage with Iran as the priority threat.

Alliance architecture now enables this repositioning—Israeli and US capabilities provide regional coverage that previously required direct Emirati presence. However, technical integration with Israeli systems constrains UAE diplomatic flexibility with China and other non-aligned partners.

The model suggests smaller Gulf states will increasingly rely on alliance burden-sharing rather than independent power projection as Iranian capabilities expand.

Until tomorrow.