Trajectory Daily Brief: 10 January 2026

UAE abandons Yemen for Iran while Trump's trillion-dollar military surge hits a wall: America's defense factories can't absorb the spending as China maps cables to cut Philippine communications.

Gulf | Conflict | UAE withdraws from Yemen to concentrate forces for anticipated Iran confrontation

Situation

The United Arab Emirates has strategically withdrawn its military presence from Yemen, ending years of direct involvement in the Saudi-led coalition’s campaign against Houthi forces. This pullback represents a significant reduction in Emirati commitments in the Horn of Africa theater.

Abu Dhabi is simultaneously consolidating military assets and refocusing strategic priorities toward the Persian Gulf region. The redeployment suggests a fundamental shift in threat assessment and resource allocation.

Context

The withdrawal contradicts conventional analysis that viewed UAE’s Yemen exit as strategic overreach or military fatigue. Instead, it reflects a calculated trade-off between competing theaters of potential conflict.

Historical precedent shows regional powers often consolidate forces when anticipating larger confrontations. The UAE appears to be applying this logic, prioritizing homeland defense and Gulf security over distant proxy engagements. Iran’s growing regional influence and military capabilities have likely influenced this strategic recalibration.

The move also signals Emirati assessment that a direct Gulf confrontation with Iran carries higher stakes than maintaining influence in Yemen’s complex civil war.

Trajectory

This force consolidation indicates UAE leadership believes Gulf tensions will escalate beyond current proxy conflicts. The strategic retreat suggests preparation for conventional warfare scenarios rather than continued asymmetric engagements.

Regional allies may need to reassess their own strategic priorities if the UAE’s threat analysis proves accurate. The consolidation could accelerate broader Gulf militarization as other states follow suit in preparing for potential direct confrontation with Iran.

Middle East | Analysis | UAE transforms Red Sea presence from fixed bases to island outposts while reallocating forces for Iran deterrence

Situation

The UAE has dismantled its major Red Sea base at Assab, Eritrea, while simultaneously constructing smaller facilities across Yemeni islands including Socotra, Abd al-Kuri, and Zuqar. This shift accompanies a broader military reallocation that began with the 2019 Yemen withdrawal.

The transformation reflects demographic constraints on a nation with just 1.2 million citizens. UAE forces previously relied on Pakistani instructors, Colombian mercenaries, and Sudanese conscripts to sustain Red Sea operations while maintaining Gulf deterrence.

Houthi strikes on Abu Dhabi in January 2022 demonstrated homeland vulnerability created by distant deployments, forcing strategic prioritization between Red Sea projection and Iranian threat response.

Context

Small states face zero-sum resource allocation that larger powers can avoid. The UAE’s “flexible outposts” model—dispersed, scalable facilities—borrows from reef ecosystems: distribute to survive, concentrate to strike. This approach reduces political liability and targeting vulnerability compared to consolidated bases.

However, Assab’s dismantlement created surveillance gaps that Iranian-backed smuggling networks exploited during the 2022 Yemen truce. The UAE traded comprehensive coverage for operational flexibility.

The 2020 Abraham Accords with Israel reflect this Iran-centric calculus, delivering $2.3 billion in Elbit Systems integration and Hermes 900 drones. But Israeli-designed threat detection frameworks constrain UAE participation in Chinese-mediated Gulf de-escalation efforts.

Trajectory

The UAE’s island strategy reveals sophisticated adaptation to small-state constraints but creates new vulnerabilities. Remote outposts provide defensible positions irrelevant to the primary Iranian threat across the Gulf.

This redistribution strategy succeeds only if Iran remains the paramount threat. Regional realignment toward China-mediated diplomacy could strand UAE forces in strategically irrelevant positions while constraining diplomatic flexibility through Israeli dependencies.

The model may prove prescient if Gulf tensions escalate, or premature if diplomatic solutions emerge that require the operational flexibility Abu Dhabi has sacrificed for tactical efficiency.

US | Defence | Industrial base cannot absorb Trump’s proposed 50% spending surge due to capacity constraints

Situation

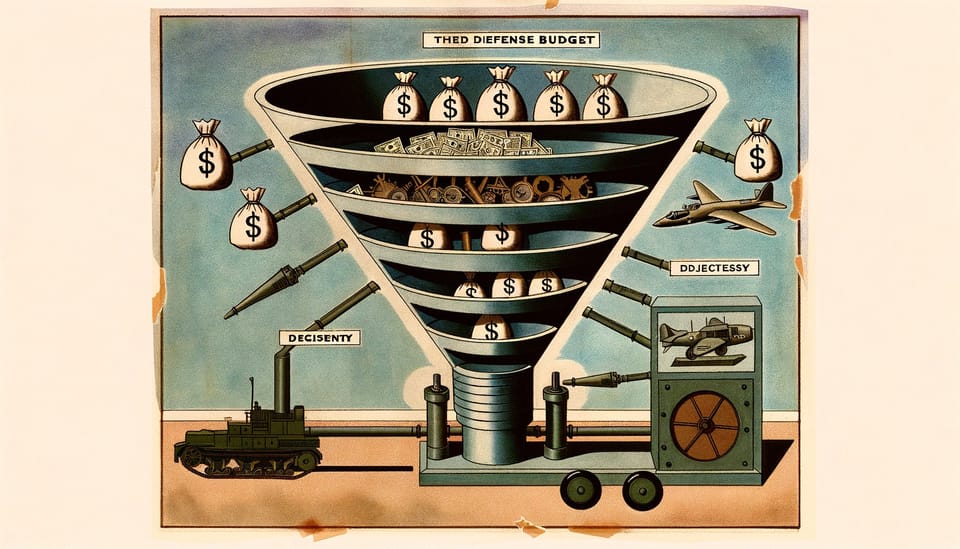

President Trump has proposed $1.5 trillion in defence spending by 2027, representing a 50% increase from the $901 billion approved for 2026. This would constitute the largest military budget surge since the Reagan buildup.

America’s defence industrial base currently operates at just 41% capacity utilization—the lowest of any major manufacturing sector. Critical production bottlenecks exist across submarine construction, munitions manufacturing, and advanced weapons systems.

The workforce crisis compounds these constraints, with defence sector turnover matching Silicon Valley’s 13.2% annual churn rate and security clearance backlogs exceeding 700,000 cases.

Context

The spending surge targets an industrial base fundamentally different from the 1980s Reagan buildup era. Today’s defence production concentrates among five prime contractors operating with minimal excess capacity, following decades of post-Cold War consolidation encouraged by Pentagon policy.

Structural constraints cannot be solved with appropriations. Only two US shipyards can build nuclear submarines, both at maximum capacity. Artillery shell production required years to expand from 240,000 to 1.2 million rounds annually after Ukraine exposed shortfalls.

Between 2017-2020, defence contractors spent 76% of free cash flow on stock buybacks rather than capacity expansion, rationally avoiding fixed costs that become politically difficult to shed when surges end.

Trajectory

More funding chasing constrained capacity will inflate costs without accelerating delivery timelines. The bottleneck lies in welding bays and skilled workers, not congressional appropriations.

Trump’s executive order demanding contractors end buybacks and invest in manufacturing addresses symptoms rather than root causes. The underlying incentive structure rewards compliance over capability and market power over manufacturing prowess.

The surge risks becoming an expensive demonstration that money cannot purchase what the industrial base cannot build, potentially weakening rather than strengthening America’s defence posture through misallocated resources.

Indo-Pacific | Defence | Philippine military command structure vulnerable to Chinese cable-cutting during Taiwan crisis

Situation

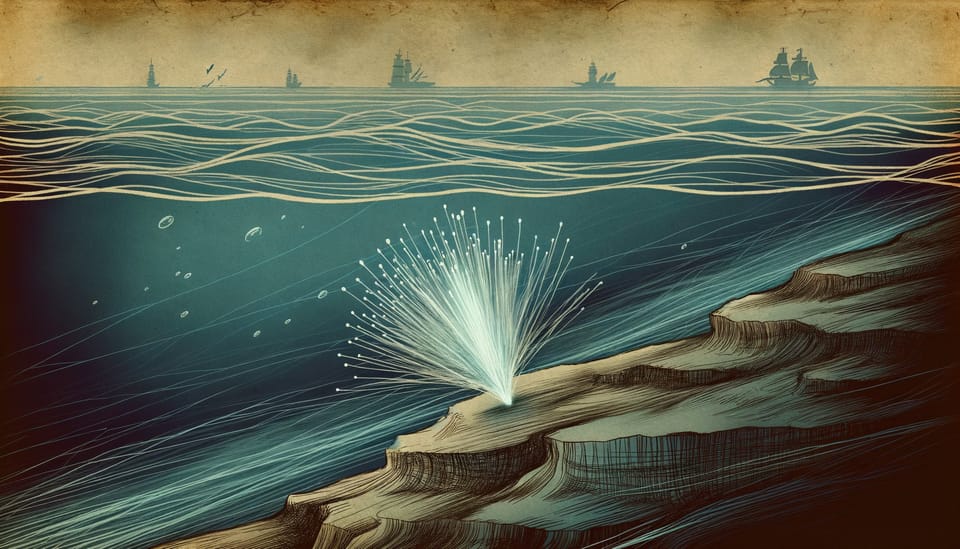

China has developed deep-sea cable cutting devices capable of severing armored fiber-optic cables at 4,000-meter depths. Chinese survey vessels have been documented mapping Philippine underwater cable routes with military precision.

Sixteen thousand kilometers of submarine cables carry 95% of Philippine international data traffic through predictable chokepoints at nine landing stations. The Armed Forces of the Philippines’ integrated command system depends on bandwidth leased from commercial providers riding this same vulnerable infrastructure.

During a Taiwan crisis involving US forces at nine Enhanced Defense Cooperation Agreement sites, China would face strong incentives to sever Philippine communications as an early military action.

Context

Modern military command architectures assume bandwidth abundance and continuous connectivity—assumptions that become fatal vulnerabilities when adversaries can target the physical infrastructure layer. The Philippines exemplifies how smaller militaries have become structurally dependent on commercial telecommunications they cannot defend.

Satellite backup systems offer megabits per terminal versus terabits per second from cables, creating impossible bandwidth constraints for data-intensive military operations. Commercial providers like SpaceX demonstrated in Ukraine they can geofence service, giving private companies veto power over state military communications.

This vulnerability extends beyond the Philippines to any archipelagic or peninsular nation whose military networks ride on civilian infrastructure passing through adversary-accessible waters.

Trajectory

The Philippine military designed its systems for peacetime connectivity, not sustained operations under communications interdiction. Rebuilding for a denied environment requires years of doctrinal change and equipment procurement that crisis timelines won’t permit.

Cable vulnerability reveals a broader strategic reality: precision targeting of infrastructure creates asymmetric advantages that conventional military balance calculations miss. China’s cable-mapping operations suggest systematic preparation for communications warfare as a conflict opening move.

The gap between assumed and actual military resilience in communications-dependent architectures may prove decisive in determining which side can maintain command coherence during the critical opening phase of any Taiwan crisis.

Yesterday’s Assessments

- The Trillion-Dollar Bottleneck

- The Philippines Cannot Defend What It Cannot Connect

- The UAE’s Red Sea Gambit: Strategic Retreat or Preparation for the Real War?

Until tomorrow.