The UAE's Red Sea Gambit: Strategic Retreat or Preparation for the Real War?

Abu Dhabi's withdrawal from Yemen was neither overextension nor weakness—it was a calculated bet that Iran matters more than the Horn of Africa. The Emirates are consolidating forces for a Gulf confrontation they believe is coming, trading influence in one theater for survivability in another.

The Quiet Pivot

When the UAE began withdrawing forces from Yemen in 2019, officials called it a shift from “military-first” to “peace-first” strategy. The framing was elegant. It was also misleading.

What Abu Dhabi executed was not retreat but redistribution—a calculated reallocation of finite military resources away from a grinding counterinsurgency toward the threat that keeps Emirati strategists awake at night: Iran. The Red Sea withdrawal reveals neither overextension nor weakness. It reveals a small state learning, painfully, that it cannot fight everywhere at once.

The UAE possesses perhaps the most capable military in the Arab world, but capability is not capacity. With a citizen population of just 1.2 million, the Emirates face arithmetic that no amount of advanced weaponry can overcome. Every soldier deployed to a Yemeni outpost is a soldier unavailable for homeland defense. Every surveillance asset tracking Houthi smuggling routes is an asset not monitoring Iranian missile batteries across the Gulf. Abu Dhabi has made its choice. The question is whether that choice will prove prescient or premature.

The Arithmetic of Small States

The UAE’s military ambitions have always exceeded what its demographics could sustain. This is not criticism; it is physics. A nation that imports 90% of its food and relies on desalination for survival cannot afford the luxury of strategic patience. It must punch above its weight or accept subordination to larger neighbors.

For a decade, Abu Dhabi tried to do both: project power across the Red Sea while maintaining deterrence against Iran. The Yemen intervention, launched in 2015 as part of the Saudi-led coalition, was meant to be quick. It became anything but. By 2019, Carnegie Endowment analysis identified “gaps in the UAE’s strategic planning capabilities” that “exacerbate the risks of overextension and reliance on less professional and less integrated forces.”

The diagnosis was precise. The UAE had built an expeditionary capability without the depth to sustain it. Its forces relied heavily on Pakistani instructors for pilot training, Colombian mercenaries for ground operations, and Sudanese conscripts for the most dangerous assignments. This dependency chain worked—until it didn’t.

The breaking point came not from military defeat but from strategic clarity. When Houthi missiles and drones struck Abu Dhabi in January 2022, they demonstrated what Emirati planners already suspected: the homeland was vulnerable precisely because so many assets were committed elsewhere. Forward buffer operations in Yemen created a zero-sum competition with homeland integrated air and missile defense. The UAE was draining its reservoir to fight fires in distant fields while its own house grew dry.

Sheikh Mohammed bin Zayed, who had championed the Yemen intervention, understood the math. He had learned at Sandhurst that small states survive through superior intelligence and decisive action, not through grinding attrition. The Yemen war had become attrition. Worse, it was attrition against an enemy that welcomed martyrdom while the UAE could not afford to lose a single Emirati soldier without depleting an irreplaceable resource.

From Assab to Archipelago

The withdrawal from Yemen did not mean withdrawal from the Red Sea. It meant transformation.

In 2021, the UAE dismantled its large fixed base at Assab, Eritrea—a facility that had anchored its Red Sea presence since 2015. Conventional analysis read this as retreat. It was actually metamorphosis. Even as Assab closed, construction accelerated on a network of smaller, more dispersed outposts across Yemeni islands: Socotra, Abd al-Kuri, Samhah, Mayun, and most recently Zuqar, where a 2,000-meter airstrip began taking shape in April 2025.

This shift from consolidated base to distributed micro-infrastructure represents what analysts call “flexible outposts”—facilities that can be scaled up or down, staffed or unstaffed, depending on operational requirements. The model borrows from reef ecosystems: disperse to survive, concentrate to strike.

The strategic logic is sound. Large fixed bases create targeting opportunities and political liabilities. They require permanent garrisons, sustained logistics, and host-nation negotiations that can turn hostile. Flexible outposts require none of these. They can be established through lease agreements that outlast electoral cycles, staffed by contractors who exist in legal ambiguity, and abandoned without the political cost of visible retreat.

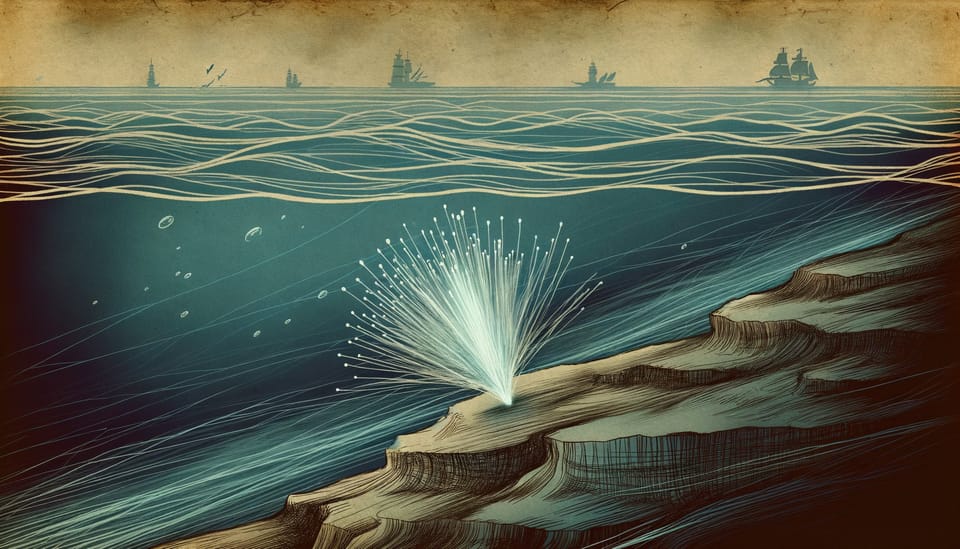

But flexible outposts also create vulnerabilities. The dismantlement of Assab’s radar infrastructure opened surveillance gaps that Houthi smuggling networks exploited during the 2022 Yemen truce. Without predictable orbital surveillance, small boats carrying Iranian weapons found new routes. The UAE traded comprehensive coverage for operational flexibility—a trade-off that looked wise until it didn’t.

The island strategy also reveals something about Emirati threat perception. Socotra’s otherworldly landscape and local folklore about supernatural phenomena provide cover for military construction; fishermen avoid “cursed” zones, reducing surveillance risk. The archipelago’s remoteness makes it defensible but also makes it irrelevant to the fight that actually matters: the one across the Gulf.

The Iran Question

Every Emirati strategic decision ultimately circles back to Tehran.

The 2023 UAE National Defense Strategy speaks of “predicting future threats” and “national readiness for defence” while highlighting “geopolitical shifts” and “emerging threats.” The document never names Iran directly. It doesn’t need to. When IAEA reports document Iranian uranium enrichment at 60% purity—with particles detected at 84%—the threat requires no elaboration.

Sheikh Mohammed bin Zayed’s worldview was forged in the 1990-91 Gulf War, when Iraq’s invasion of Kuwait demonstrated how quickly regional order could collapse. Iran represents the same existential category: a larger neighbor with revolutionary ideology, missile capabilities that can reach every Emirati city, and proxy networks that have already struck the homeland. Political Islam and Iranian expansionism are, in MBZ’s framework, threats that cannot be accommodated. They can only be contained or defeated.

This explains the Abraham Accords. The 2020 normalization with Israel was not primarily about economics or tourism. It was about acquiring a security partner with proven capabilities against Iranian proxies and nuclear facilities. The treaty’s language explicitly commits both parties to “advance security and stability”—diplomatic code for shared threat perception.

The accords have delivered tangible military benefits. A $2.3 billion Elbit Systems deal integrated Israeli electronic defense systems into UAE aircraft. Hermes 900 drones, designed for interoperability within US-led regional architecture, now operate from Emirati bases. But these acquisitions create dependencies that constrain Abu Dhabi’s diplomatic flexibility. Aircraft protection systems operating within Israeli-designed threat detection frameworks make it harder—not easier—to participate in Chinese-mediated Gulf de-escalation efforts.

Sheikh Tahnoun bin Zayed, the national security adviser who conducted secret diplomatic missions to Tehran between 2019 and 2021, understands this tension. His core belief—that economic interdependence prevents military conflict more effectively than deterrence—sits uneasily alongside his brother’s conviction that Iran represents an existential threat requiring containment. The brothers are not in conflict; they are hedging. The UAE maintains back channels to Tehran while building military capabilities explicitly designed for Iranian scenarios.

The Proxy Paradox

The UAE’s withdrawal from direct Yemen operations did not end its influence there. It transformed it.

The Southern Transitional Council (STC), an Emirati-backed separatist movement, has evolved from dependent proxy to autonomous actor. In December 2025, the STC seized Hadramout and Aden without direct UAE military support, demonstrating that Abu Dhabi’s investment in local capacity-building had succeeded—perhaps too well. The STC now rejects Presidential Leadership Council decisions it considers illegitimate, creating a proxy that no longer requires its patron’s permission.

This outcome illustrates a structural problem with proxy warfare. The UAE built tribal militia partnerships to avoid deploying Emirati citizens, but those partnerships validated tribalism as an effective military organizing principle—undermining Abu Dhabi’s domestic conscription program, which aims to transcend tribal identities and build national cohesion. The Emirates cannot simultaneously celebrate tribal warriors in Yemen and demand that young Emiratis abandon tribal loyalties at home.

The proxy model also creates legal exposure. International law’s attribution threshold—the “effective control” doctrine—incentivizes converting state military operations into privatized militia operations. The higher the evidentiary bar for proving state responsibility, the greater the incentive to obscure command relationships. UAE-backed forces in Yemen operate in precisely this ambiguous space, enabling operations that would be legally problematic if conducted by uniformed Emirati soldiers.

But ambiguity cuts both ways. When Saudi airstrikes hit UAE supply ships at Mukalla port, the incident revealed that even coalition partners cannot always distinguish Emirati assets from legitimate targets. The flexible, deniable infrastructure that protects the UAE from legal accountability also protects it from allied coordination.

The Insurance Premium

War risk insurance tells a story that diplomatic statements cannot.

Lloyd’s Joint War Committee maintains a Listed Area designation for the Red Sea, requiring vessels transiting the region to pay premiums of 0.5-1% of vessel value per voyage. This algorithmic risk pricing creates what might be called a financial event horizon: a threshold where the cost of maintaining UAE-flagged vessels in contested waters exceeds the strategic benefit of physical presence.

The UAE appears on both sides of this calculation. DP World’s 2025 investment portfolio—$2.5 billion committed to ports in India, Africa, South America, and Europe—conspicuously avoids Red Sea infrastructure. The pattern suggests deliberate rebalancing away from contested maritime zones toward markets that feed data and cargo into Gulf chokepoints without requiring presence in the chokepoints themselves.

This is not retreat. It is repositioning. The UAE cannot control the Red Sea, but it can control the nodes that determine what flows through it. Jebel Ali port, already the region’s largest, becomes more valuable as Red Sea transit becomes more dangerous—every Houthi attack that diverts shipping around the Cape of Good Hope increases demand for UAE transshipment facilities.

The strategy has limits. Houthi maritime attacks have accidentally demonstrated the vulnerability of subsea cables that carry far more economic value than surface shipping. The spectacle of burning tankers distracts from the infrastructure that actually matters: fiber optic lines carrying global financial transactions. If those cables become targets, no amount of port investment compensates.

Deterrence Without Victory

Finland’s Cold War military doctrine offers an unlikely template for understanding UAE strategy.

From 1945 to 1985, Helsinki maintained military capability while accepting geopolitical subordination to the Soviet Union. Finnish doctrine aimed for “defensive credibility without victory illusion”—the ability to impose costs on any invader without the pretense that Finland could defeat the Red Army. The goal was not to win but to make conquest expensive enough that Moscow would prefer accommodation.

The UAE faces analogous constraints. It cannot defeat Iran in a conventional war. Iranian missiles can reach every Emirati city; Iranian proxies have already demonstrated the ability to strike critical infrastructure. But Abu Dhabi can make any Iranian attack catastrophically costly—not through military victory but through the certainty that conflict would trigger American intervention.

This explains the September 2024 designation of the UAE as a “Major Defense Partner”—a status previously held only by India. The designation formalizes what was already true: American security guarantees underwrite Emirati risk-taking. The Abraham Accords’ language about “sharing the security burden” transforms UAE force withdrawals from Red Sea positions into premium reductions on an insurance policy where Israel and the United States become co-insurers of Gulf security.

The strategy is elegant but fragile. It assumes American commitment remains credible, Israeli cooperation remains politically sustainable, and Iranian decision-making remains rational. None of these assumptions is guaranteed.

What Breaks First

If current dynamics continue, the UAE faces three failure modes.

First, proxy mutation. The STC’s evolution from dependent client to autonomous actor demonstrates that proxies eventually develop their own interests. Emirati-trained forces in Yemen, Somaliland, and Libya may conclude that their patrons’ priorities no longer align with their own. When that happens, the UAE loses influence without recovering the resources it invested.

Second, alliance entanglement. Israeli electronic warfare systems integrated into UAE aircraft create technical dependencies that function as behavioral constraints. Abu Dhabi cannot easily pivot toward Chinese-mediated regional arrangements when its military infrastructure operates within Israeli-designed frameworks. The price of advanced capability is reduced strategic autonomy.

Third, temporal mismatch. Iranian strategic culture operates on generational timescales rooted in Shia eschatology and imperial memory. UAE planning cycles optimize for conventional threats within observable timeframes. If Iranian leadership operates within frameworks where the Hidden Imam’s return renders rational-actor assumptions irrelevant, Emirati deterrence calculations may prove meaningless.

The most likely failure mode is not dramatic collapse but gradual erosion. The UAE will continue withdrawing from exposed positions, continue investing in flexible outposts, continue hedging between American alliance and Chinese economic partnership. Each individual decision will appear rational. The cumulative effect may be strategic incoherence—a state that has optimized for every threat except the one that actually materializes.

The Fork Ahead

Abu Dhabi faces a choice it has spent a decade avoiding.

Option A: Double down on the American alliance, accept the constraints of Israeli partnership, and prepare for a Gulf confrontation that may never come. This path offers security guarantees but sacrifices diplomatic flexibility. It assumes American commitment remains credible through multiple administrations and that Israeli cooperation survives the Abraham Accords’ collapsing public support—two-thirds unfavorable in Gulf states by 2022.

Option B: Pursue genuine equidistance, maintaining security ties with Washington while deepening economic integration with Beijing and diplomatic channels with Tehran. This path preserves optionality but dilutes deterrence. It assumes Iran can be accommodated through economic interdependence—a bet that Sheikh Tahnoun believes but his brother doubts.

Current settings default to neither. The UAE is hedging, maintaining incompatible commitments that cannot all be honored simultaneously. This works until it doesn’t. When crisis forces choice, Abu Dhabi will discover which relationships were real and which were performative.

The Red Sea withdrawal was not a signal of overextension or repositioning. It was both—an admission that the Emirates cannot sustain multi-theater operations and a bet that the Gulf matters more than the Horn of Africa. Whether that bet proves wise depends on questions Abu Dhabi cannot answer: When will Iran’s nuclear program cross the threshold that forces action? Will American security guarantees survive domestic political realignment? Can proxy forces be controlled once they no longer need their patrons?

Sheikh Mohammed bin Zayed built his strategic framework on a simple premise: small states survive through superior intelligence and decisive action. The Yemen withdrawal was decisive. Whether it was intelligent remains to be seen.

Frequently Asked Questions

Q: Has the UAE completely withdrawn from Yemen? A: No. The UAE reduced direct military presence beginning in 2019 but maintains influence through proxy forces, particularly the Southern Transitional Council, and continues operating flexible outposts on Yemeni islands including Socotra and Mayun. The withdrawal was a shift in method, not abandonment of interest.

Q: Why does the UAE view Iran as an existential threat? A: Geographic vulnerability and ideological opposition combine to create acute threat perception. All UAE population centers lie within range of Iranian missiles, critical infrastructure including desalination plants presents concentrated targets, and Iran’s revolutionary ideology explicitly challenges Gulf monarchies’ legitimacy. The January 2022 Houthi strikes on Abu Dhabi demonstrated that Iranian proxies can reach the homeland.

Q: What did the Abraham Accords provide the UAE militarily? A: Beyond diplomatic normalization, the accords enabled defense cooperation including a $2.3 billion Elbit Systems electronic warfare deal and acquisition of Hermes 900 drones designed for interoperability with US-led regional architecture. Israel’s proven capabilities against Iranian nuclear facilities and proxy networks offered the UAE a security partner with relevant operational experience.

Q: How does the UAE maintain military capability with such a small citizen population? A: Through extensive reliance on foreign personnel. Pakistani officers staff operational squadrons and provide pilot training, Colombian mercenaries with counterinsurgency experience conduct ground operations, and Sudanese conscripts fill infantry roles. This dependency chain enables force projection but creates vulnerabilities when any link fails.

The Waiting Game

In the end, the UAE’s Red Sea withdrawal may be remembered as either strategic genius or catastrophic miscalculation. The difference depends entirely on timing.

If Iran’s nuclear program triggers regional conflict within the next five years, Abu Dhabi’s decision to consolidate forces for homeland defense will appear prescient. Every asset withdrawn from Yemen will be an asset available for the fight that mattered. The flexible outposts on remote islands will prove irrelevant curiosities—expensive hedges against threats that never materialized.

If the Gulf remains stable while Red Sea chaos intensifies, the withdrawal will look like abandonment. Houthi attacks on shipping will continue disrupting global trade. Chinese and Turkish influence will fill vacuums the UAE created. And Abu Dhabi will watch from across the water as others shape the maritime corridor that once seemed central to Emirati ambitions.

The Emirates have made their bet. They are waiting, like Finland once waited, for history to render its verdict. The difference is that Finland had seventy years to discover whether its strategy worked. The UAE may not have seventy months.

Sources & Further Reading

The analysis in this article draws on research and reporting from:

- Carnegie Endowment: Evolving UAE Military and Foreign Security Cooperation - Analysis of UAE force structure limitations and overextension risks

- Carnegie Endowment: Flexible Outposts - Examination of UAE’s shift from fixed bases to distributed infrastructure

- MERIP: The UAE and the Infrastructure of Intervention - Investigation of UAE military presence and proxy relationships in Yemen

- DP World Investment Announcement - Details on UAE port investment strategy and geographic priorities

- Chatham House: Abraham Accords Security Landscape - Analysis of UAE-Israel defense cooperation framework

- Congressional Research Service: UAE Country Profile - Overview of US-UAE defense relationship and Major Defense Partner designation

- UAE Ministry of Defence: National Defense Strategy - Primary document outlining UAE strategic framework

- Washington Institute: Arab Public Opinion on Abraham Accords - Survey data on regional attitudes toward normalization